It’s Budget Time in Congress; Let’s Talk About the Money

As the majority party in Congress, Republicans unveiled their national budget proposal for 2018. Out of the gate, Democrats want it thrown in the trash.

Republican leaders laud the plans as tax reform, calling the budget bill the first step to a “Unified Framework for Fixing our Broken Tax Code.”

Democratic Senator Bernie Sanders from Vermont scorched the proposed budget: “…[it] is not a bad bill. It’s a horrific bill.” He raved on, “…it’s immoral and despicable.”

President Trump declared, “This [the budget bill passing in the Senate] now allows for the passage of large-scale tax cuts (and reform), which will be the biggest in the history of our country!”

All the news outlets reported on details of the proposed budget. The Tax Policy Center (TPC) details how the Republican budget decreases revenue streams by $2.4 trillion over ten years and adds $1.5 trillion to the national spending debt.

The plan does cut taxes for low and middle-income earners as its backers claim, but as TPC reports, only very modestly. Most of the benefits from tax breaks would go to the top 1% income bracket.

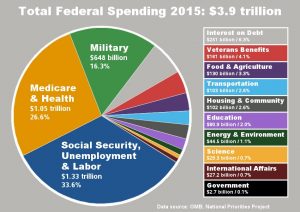

The budget as proposed also means massive cuts to Medicaid and Medicare among other government spending.

To reconcile the budget divide, it is helpful to look at the big picture on corporate taxes. There are revenue streams of money and there are spending streams of money. When judging the fairness of proposed federal spending, it is useful to keep federal revenue streams in mind.

The U.S. corporate tax rate is 35%. Many have long argued that the rate is too high. The solution is simple, some reasonably debate. Lower the corporate tax rate to 20% and overhaul the tax code—eliminating many of the tax deductions and loopholes.

Problem is, there are a massive number of tax breaks, loopholes and provisions used to maneuver the actual amount of taxes paid to the revenue stream. As Politico reveals, it is difficult to lower the corporate tax rate and keep all the tax breaks. Every time leaders try to reign in the loopholes, the special interests raise a ruckus, …and the system remains bottlenecked.

As U.S. News reports, some frequently used tax deductions are:

- Business Dividends

- Deferral of Income from controlled foreign corporations

- Accelerated depreciation of machinery and equipment

- Exclusion of interest on public purpose state and local bonds

- Deductions for U.S. production activities

- Credit for low-income housing investments

- Expensing of research and experimentation expenditures

- Graduated corporation income tax rate

- Exclusion of interest on life insurance savings

- Exclusion of interest on hospital construction bonds

- Deductibility of charitable contributions, other than education and health.

The proper term is tax deduction, credit, or provision, but when all the benefits add up, it is called a hefty price. Our revenue stream suffers at the loss of the tax money.

Meanwhile, the Republican budget calls for slashing more social services funding like Medicaid, Medicare, and food stamps even.

The money spent on food stamp programs falls under agricultural spending, which is not even a big slice of the pie. Cutting spending from the wrong places in a national budget can also cause problems for a thriving economy.

In 2014, Huffington Post detailed how austerity measures (deep cuts to social services) are harming that goal in our country. We are cutting services vital to a thriving economy, arguably for naught if looking at the numbers.

While enjoying massive tax breaks and deductions, many large corporations store massive amounts of money in off-shore bank accounts. According to reporting by the Atlantic in 2016, 50 corporations had stashed more than a trillion dollars in “offshore shell companies,” in order to receive a lower tax rate.

That’s more money not going to the revenue stream.

There are also tax inversions that large corporations exploit to lower tax burdens and increase profits. The Economist reports that tax inversions are a symptom of the bigger problem. Inversion means to maneuver around tax laws by acquiring or merging with a foreign entity and move headquarters to be accountable to more favorable tax rates than the U.S.

Yet more money not going to the revenue stream.

The bottom-line for any functioning economy is to have healthy revenue streams and healthy spending habits. Current policy gives corporations the freedom to exploit the tax system and not pay taxes while reaping massive amounts of government subsidies and additional tax breaks.

There is an old saying, whoever controls the money makes the rules. Since the wealth of this nation belongs to the citizens, it is necessary to talk about the money and watch how elected leaders vote on spending tax revenue.

Vicki is a Denver native and has always lived in Colorado. She has returned to Arapahoe Community College (ACC) again to obtain a degree in Journalism. In 2007, she received her A.A.S. in Paralegal Studies at ACC.

Vicki enjoyed...