College Cost Conundrum

Editor’s Note: This article was originally published in the TJ Journal.

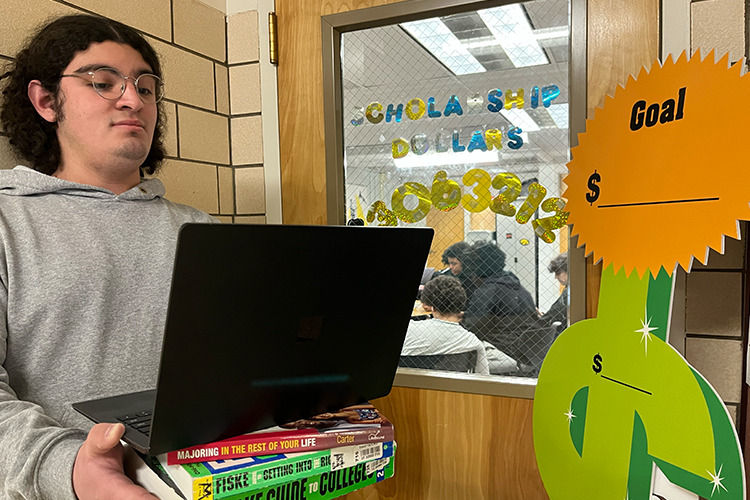

The nationwide cost of attending college is prohibitively high for some students. Achieving good grades, a high GPA, and an average SAT/ACT score may no longer be the top concern among high school students applying for college. Recently, one of the biggest concerns has been the cost of tuition.

In 2022, the U.S. News World Report found that in-state tuition and fees at national public universities have increased by 175% since 2003. This increase surpasses the rising out-of-state tuition costs, which increased by 141% and private university costs, which saw a 134% increase in the same period.

As a result, eager students willing to continue their education after high school may not be able to attend their dream colleges, even if they are accepted. Thomas Jefferson High School’s Denver Scholarship Foundation college advisor, Emily Webster, has witnessed these effects firsthand.

“The high cost of college can certainly be a discouraging factor for some students. They’ll see the price tag of a college they’re otherwise interested in and won’t pursue it because perhaps they haven’t seen all the available resources to them or they just know they and their families can’t cover that cost of college,” Webster said. “It’s stressful, it’s absolutely disappointing to have your eyes set on an opportunity and feel like you cannot access it.”

The rising cost of college, which has outpaced inflation and every other service besides hospital care, is attributed to several factors. This includes the growing demand for a college degree, rising financial aid offers, lower state funding, increasing costs of paying for administrators, and bloated student amenities packages.

A 2021 Georgetown study, detailing how youth policy in the United States has failed catastrophically to prepare rising students for the future, found that despite these exponential price increases, the average earnings of people aged 22 to 27 only increased by 19% since 1980.

The Georgetown study concluded that “it is far better to be born rich and white than smart and poor in America,” seeing as gifted students from low-income families tend to have lower high school graduation rates than their more affluent counterparts.

Young people are also disadvantaged in seeking a stable job after college. The Georgetown study stated that “today’s young adults need both post-secondary education in a suitable field of study and high-quality work experience to get a good job on a promising career pathway. It now takes many young workers until their 30s to reach this milestone.”

The need for a college degree and more training in the workforce is growing, and it now takes longer for young people to start earning middle-class wages than in the past. Thus, the price tag for this education becomes a concern if it may not pay for itself.

“I think there’s great value in pursuing higher education,” Webster said. She believes the ultimate goal of post-secondary education is to provide students with the skills needed to access jobs where they can make a living wage and fulfill some of their interests.

When students are considering college, they often look at programs of interest and gauge whether the college offers a major in their desired field, the location, and the financial fit. For those with limited income, the financial fit tends to be at the top of the list.

Generally, students have been vigilant about looking for scholarships even if they are not in dire financial need. Some colleges in Colorado offer a “promise scholarship” when a student qualifies for Pell Grants through the Federal Application for Student Aid (FAFSA). If students are eligible, the college will cover the difference between the amount allocated from the Pell Grant and the total cost of tuition.

Work-study programs are also options for students needing financial aid, allowing students to work on their college campus and earn a paycheck as if they worked at any other job.

“[Work-study programs] recognize you as a student first, and can be more flexible with your scheduling to allow for study time around exams,” Webster said. “If you’re communicating with your supervisor, you can get a schedule that works for you a little more easily [than] some off-campus jobs.”

In response to these financial concerns, many universities have increased their institutional scholarship offerings, with some covering more than half the cost of attendance. This is most common among out-of-state schools, which have offered significant financial aid to students with strong applications to compete with cheaper in-state options.

As a last resort, students can take out student loans if they believe they will make enough money in their field to pay them back promptly. These can close the small gap between the financial aid offered and the final cost of tuition, but they come with a risk.

According to the Education Data Initiative, the average borrower takes twenty years to pay back their loan. Among 44 million American students, with an average of $37,172 of debt per person, this amounts to $1.5 trillion in collective debt nationwide. Student loan debt has also increased by 76% since the class of 2000, outpacing inflation by 41%.

With colleges becoming so competitive and limited financial aid slots available, the pressure is on for students to craft compelling applications that stand out from their peers.

“I think colleges are looking for a well-rounded student… a student who is engaged in their school community as well as the greater community is important,” Webster said. “If the student has the ability to do volunteer work, that’s great.”

Webster further encourages students to practice reflective writing before their senior year to think about how they might answer essay topics, ponder their interests and pursue extracurricular involvement to improve their resumes.